This coverage is excluded as a de minimis fringe benefit. When you are reimbursed for a claim to repair your home or even replace it if its destroyed such as in a fire no tax is owed.

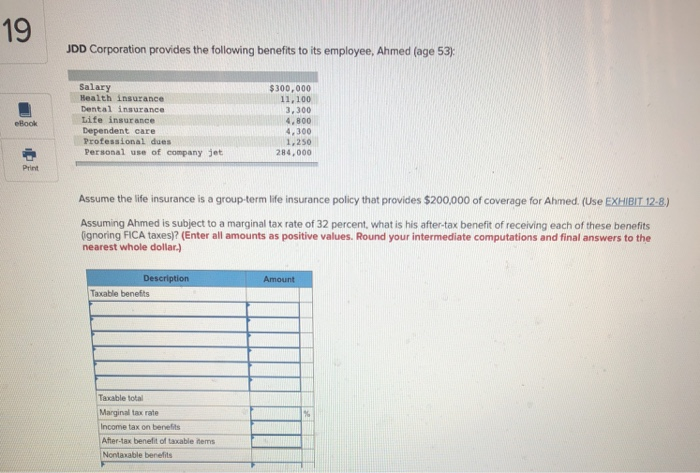

Solved 19 Jdd Corporation Provides The Following Benefits

Solved 19 Jdd Corporation Provides The Following Benefits

The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000.

Taxable life insurance benefits. This tax free exclusion also. Employer paid premiums for group life insurance dependant life insurance accident insurance and critical illness insurance are taxable benefits and the amounts paid on your behalf will be added to your taxable income. See topic 403 for more information about interest.

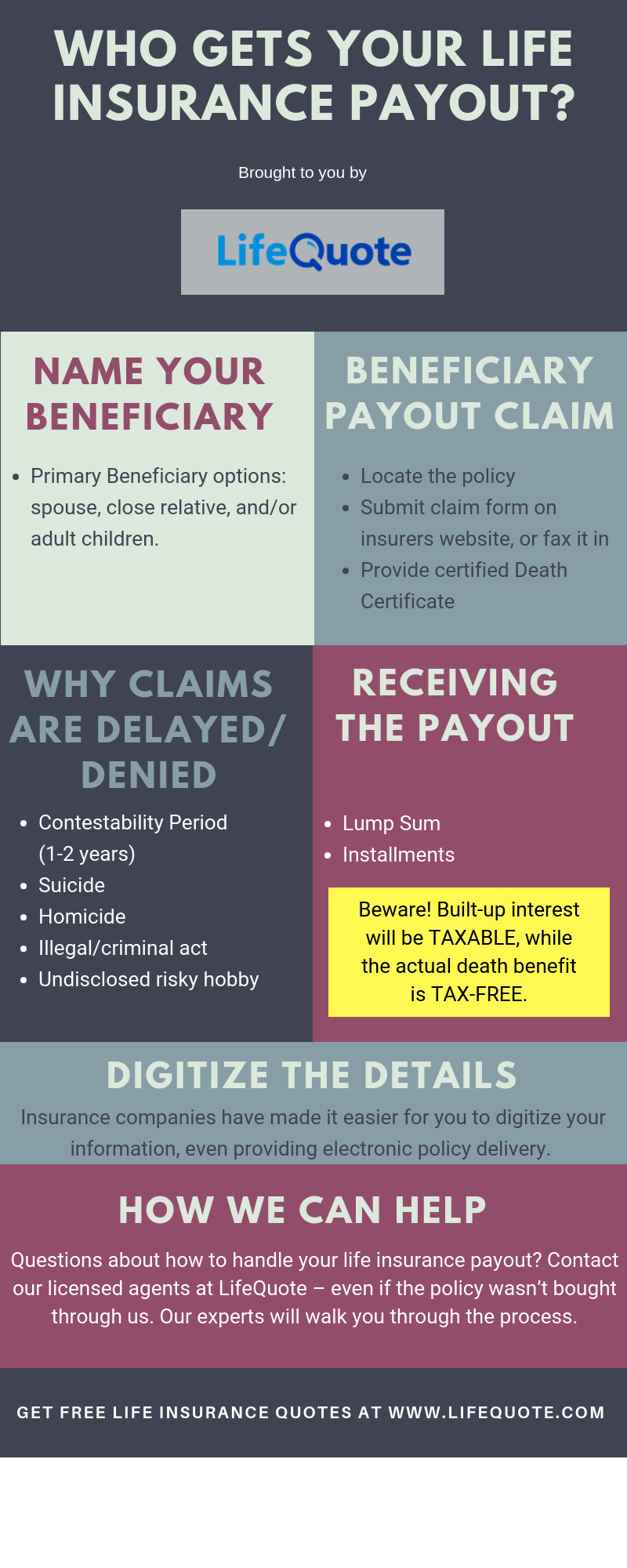

Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. Are life insurance proceeds taxable. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

This is the only tax benefit that is offered by all types of life insurance policies including term life and the various types of permanent life insurance. Life insurance including death benefits is usually not taxable. In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available.

This most obvious tax benefit of life insurance is the fact that the beneficiaries of a life insurance death benefit do not pay income tax on the proceeds. However there are situations when money from a tax benefit may get taxed. However any interest you receive is taxable and you should report it as interest received.

Whether you receive a lump sum or periodic payments as long as the amount does not exceed the death benefit. That money isnt considered taxable income. In most but not all cases life insurance death benefits are not taxable income.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. In quebec premiums for health and dental insurance are also considered a taxable benefit. Life insurance can give your loved ones financial security should you die.

Canadian Taxation Of Life Insurance Ninth Edition

Canadian Taxation Of Life Insurance Ninth Edition

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Tax Free Retirement Strategy With Permanent Life Insurance Texas

Tax Free Retirement Strategy With Permanent Life Insurance Texas

Life Insurance Super How They Can Work Together For You Cover

Life Insurance Super How They Can Work Together For You Cover

Income Tax Deductions List Fy 2019 20 List Of Important Income

Income Tax Deductions List Fy 2019 20 List Of Important Income

Limited Pay Whole Life Insurance

Limited Pay Whole Life Insurance

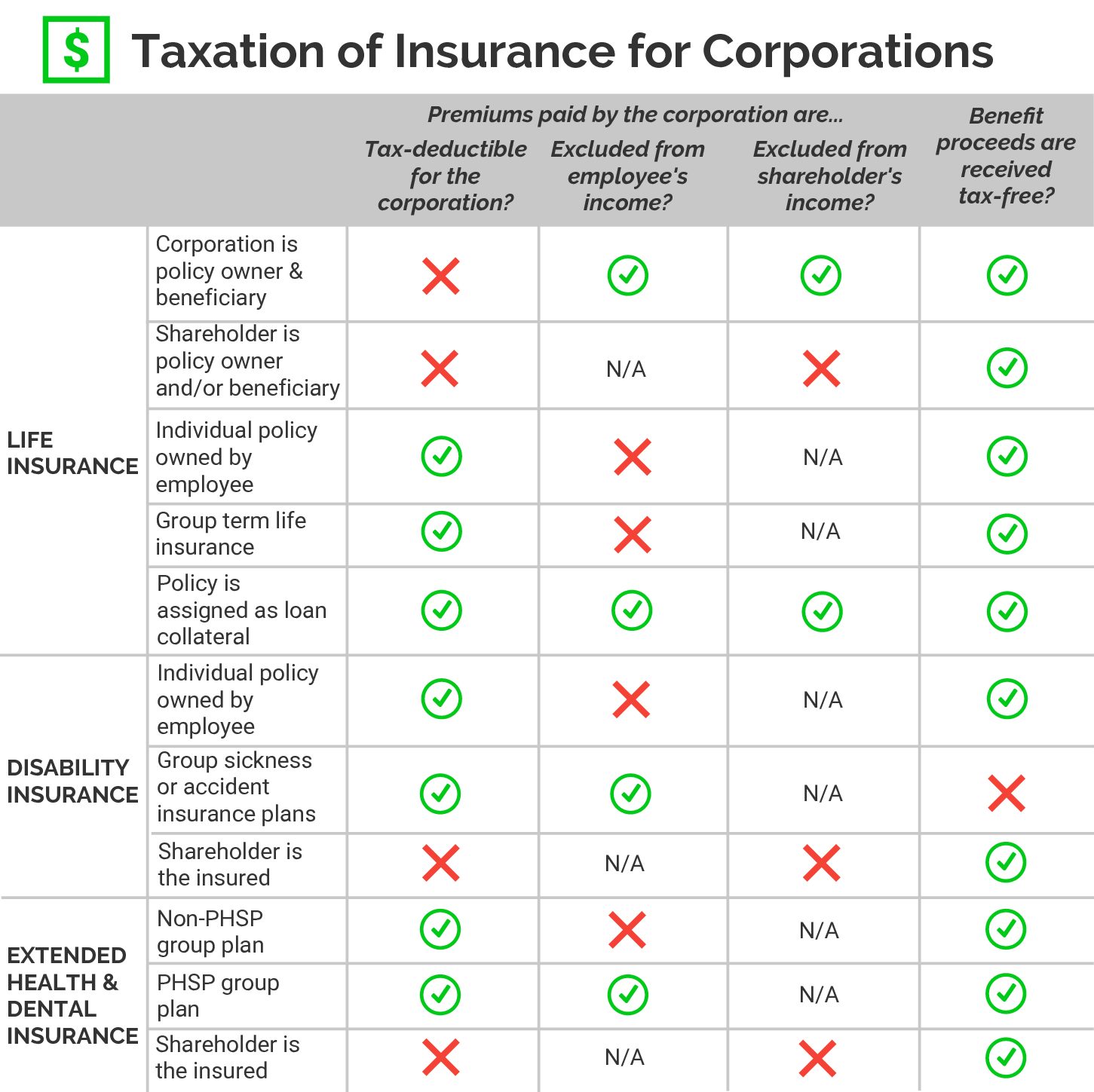

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

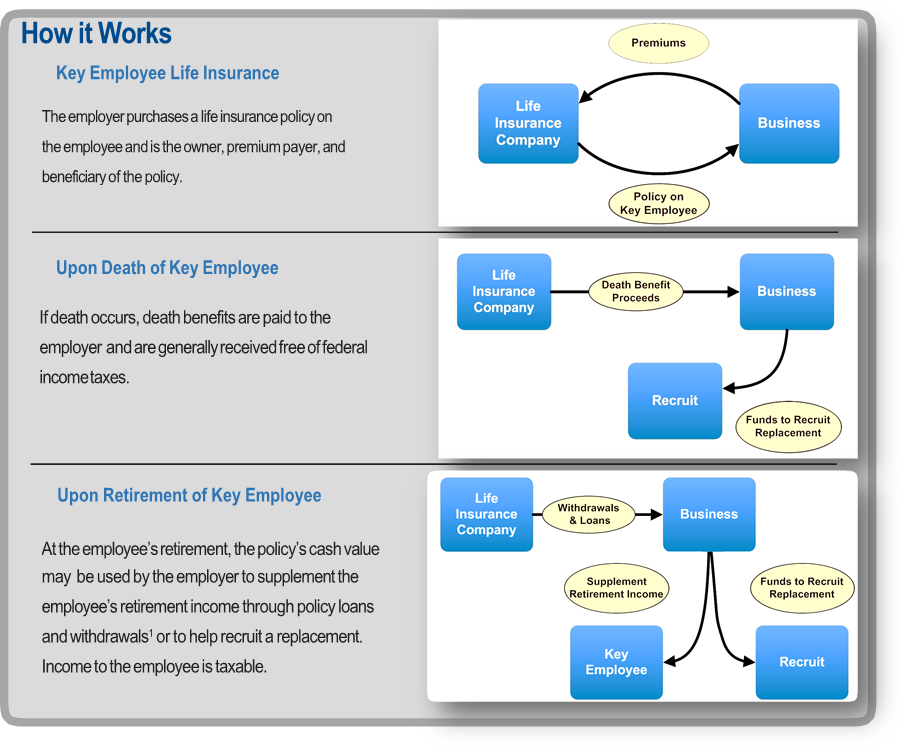

Key Employee Life Insurance Gulfport Ms Mayfield Associates

Key Employee Life Insurance Gulfport Ms Mayfield Associates

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

The Top Cash Value Life Insurance Tax Benefits For You

The Top Cash Value Life Insurance Tax Benefits For You

Life Insurance Policies Life Insurance Policies Taxable Income

Life Insurance Policies Life Insurance Policies Taxable Income

Solved 11 The Cash Value In A Whole Life Insurance Polic

Solved 11 The Cash Value In A Whole Life Insurance Polic

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

Pros And Cons Of Group Life Insurance Through Work

Pros And Cons Of Group Life Insurance Through Work

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

/hispanic-saleswoman-talking-to-clients-in-living-room-580504711-5995f8d722fa3a001149763c.jpg) Life Insurance Death Benefits Estate Tax

Life Insurance Death Benefits Estate Tax

Is Life Insurance Taxable Visual Ly

Is Life Insurance Taxable Visual Ly

Is Life Insurance Taxable Tax Advantages Of Life Insurance

Is Life Insurance Taxable Tax Advantages Of Life Insurance

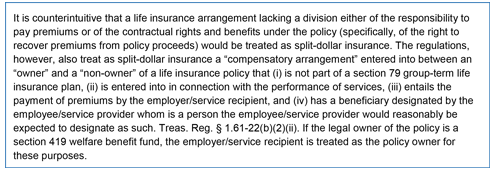

Term Insurance Best Term Plan Policy Online Max Life Insurance

Term Insurance Best Term Plan Policy Online Max Life Insurance

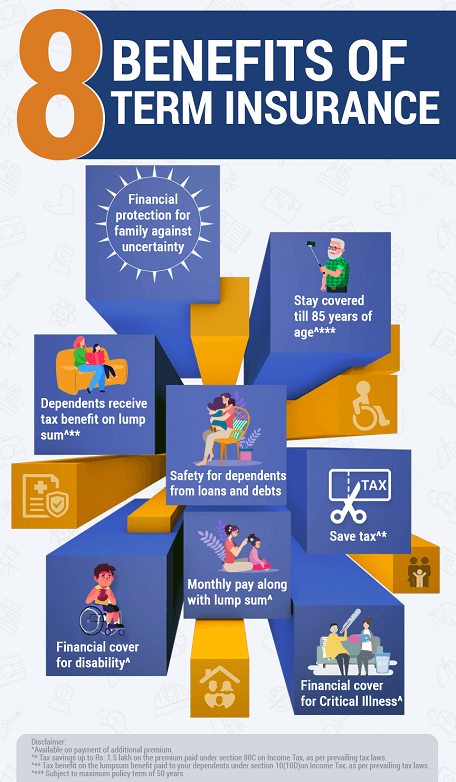

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India