How big data can make insurance better. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout.

Income Tax On Maturity Amount Of Life Insurance Policy Simple

Income Tax On Maturity Amount Of Life Insurance Policy Simple

Employer paid life insurance may have a tax cost.

Tax life insurance. Life insurance protects your family from your financial debts and obligations after you die by providing a death benefit but it also may be used for business purposes to compensate a company for the loss of a key person in the company. This tax free exclusion also. If you have taken out life insurance to provide a lump sum or regular income to your loved ones when you die there is usually no income or capital gains tax to pay on the proceeds of the policy.

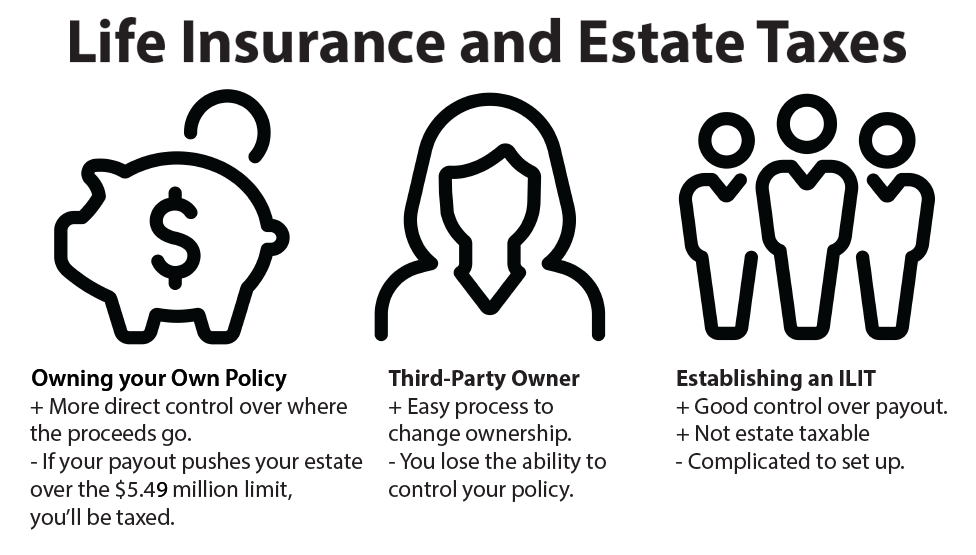

Life insurance proceeds may be tax free depending on what proceeds you or your beneficiaries receive. However if the total value of your estate is more than 325000 inheritance tax iht will be deducted from your insurance pay out at a rate 40. See topic 403 for more information about interest.

In 2018 a fiduciary standard rule on retirement products by the united states department of labor posed a possible risk. This may occur if the policys beneficiary dies before they can receive the payout and there are no other beneficiaries. How to donate a life insurance policy.

Sometimes life insurance payouts are paid to the estate of the deceased rather than directly to a beneficiary. However any interest you receive is taxable and you should report it as interest received. How life insurance can still protect clients despite tax changes.

As always both the united states congress and state legislatures can change the tax laws at any time. The tax ramifications of life insurance are complex. The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you.

Kevin wark llb clu tep is managing partner integrated estate solutions and tax consultant conference for advanced life underwriting. Our guide to life insurance tax outlines when tax is applicable to life insurance payouts. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

Heres a primer on what to do if your life insurance beneficiary dies before you. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. Find out how to get tax free life insurance and compare quotes.

The policy owner would be well advised to carefully consider them.

Life Insurance Premium Deduction U S 80c Simple Tax India

Life Insurance Premium Deduction U S 80c Simple Tax India

Life Insurance Tax Benefit Tax Deduction Rules Of Life Insurance

Life Insurance Tax Benefit Tax Deduction Rules Of Life Insurance

Is Life Insurance Tax Deductible Einsurance

Is Life Insurance Tax Deductible Einsurance

Life Insurance 3 Income Tax Advantages Geminired Virtual Services

Life Insurance 3 Income Tax Advantages Geminired Virtual Services

The Role Of Life Insurance In Retirement Planning

The Role Of Life Insurance In Retirement Planning

Taxation Of Life Insurance Brian So Insurance

Taxation Of Life Insurance Brian So Insurance

Effective Rates Of Tax Incentives For Life Insurance Download

Tax Benefits On Life Insurance Linksking

Tax Benefits On Life Insurance Linksking

Using Tax Benefits Of Life Insurance In Your Financial Plan

Using Tax Benefits Of Life Insurance In Your Financial Plan

How Life Insurance Is Taxed Quotacy

How Life Insurance Is Taxed Quotacy

Tax Deductions For Life Insurance Policies Piggy Blog

Tax Deductions For Life Insurance Policies Piggy Blog

Your Family Can Help You Save Taxes Here S How Icici Pru Life Blog

Your Family Can Help You Save Taxes Here S How Icici Pru Life Blog

Tax Saving Life Insurance Plans You Need To Consider This Year

Tax Saving Life Insurance Plans You Need To Consider This Year

New Rules Will Affect The Taxation Of Canadian Life Insurance

New Rules Will Affect The Taxation Of Canadian Life Insurance

Life Insurance Tax Axa Fee Png 592x591px Insurance

Life Insurance Tax Axa Fee Png 592x591px Insurance

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Is Life Insurance Tax Deductible In Australia Iselect

Is Life Insurance Tax Deductible In Australia Iselect

Are Life Insurance Premiums Tax Deductible True Blue Life Insurance

Are Life Insurance Premiums Tax Deductible True Blue Life Insurance

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Do You Know All The Tax Benefits Of Your Life Insurance Policy

Do You Know All The Tax Benefits Of Your Life Insurance Policy

How Your Lic Premiums Can Help You Save Income Tax

How Your Lic Premiums Can Help You Save Income Tax

Amazon Com Money Wealth Life Insurance How The Wealthy Use

Amazon Com Money Wealth Life Insurance How The Wealthy Use

How To Avoid An Inheritance Tax Charge On Life Insurance Payouts

How To Avoid An Inheritance Tax Charge On Life Insurance Payouts