Feldman president and ceo of the life and health insurance foundation for education life a nonprofit organization that helps consumers make insurance decisions. There are times when it makes sense to buy life insurance for children as a part of a long term financial strategy says marvin h.

After all when you think of the typical term life policyholder you probably think of someone who is married possibly with children and who has significant financial obligations.

Term life insurance children. 50000 of level term life insurance coverage. Wondering what is child term life insurance child term life insurance is a way to ensure that your children will always have coverage available to them no matter what ailments they might develop later in life. Buying life insurance on your kids is not the only way to get coverage on them.

A child term life insurance rider will cover all children under 18 for one set price. You can provide life insurance protection and guarantee their insurability regardless of future health changes. Childrens protect group level term insurance offered through our carrier 5star life insurance company makes it easy to secure peace of mind.

Advocating cash value life insurance. So to secure insurance coverage on your children youll have to own a life insurance policy yourself. Life insurance for children is often marketed to parents or grandparents as a way.

Term insurance for children. Term life insurance for children may not be sold as a stand alone policy. Term life insurance for children if you are looking for a convenient way to get quotes on different types of insurance then look no further than our insurance quotes service.

If you compare term vs whole life insurance whole life insurance costs six to ten times more compared to term life insurance. The question of whether to buy life insurance for children sparks strong debate about the value of such policies. Even though child policies are generally small were talking around 25000 to 150000 of coverage the cost per benefit amount is still highso its far from cost effective.

Another great route to take and often a less expensive alternative than buying an individual life insurance policy on each child is to purchase a life insurance with a child rider. Term life insurance children if you are looking for insurance protection you can trust then our insurance quotes service can help you find someone you feel comfortable with. At first blush taking out a term life insurance policy on a child might seem counterintuitive and unnecessary.

Instead you can obtain this coverage as a rider or add on to your own coverage.

Key Benefits To Be Considered While Buying Child Insurance

Key Benefits To Be Considered While Buying Child Insurance

Best Gift For Your Children Insurance Marketing Investing

Best Gift For Your Children Insurance Marketing Investing

Term Vs Whole Life Insurance What S The Difference Mason Finance

Term Vs Whole Life Insurance What S The Difference Mason Finance

5 Term Life Insurance Mistakes To Avoid Daveramsey Com

5 Term Life Insurance Mistakes To Avoid Daveramsey Com

Life Insurance Is Term Life Always Enough Moneysense

Life Insurance Is Term Life Always Enough Moneysense

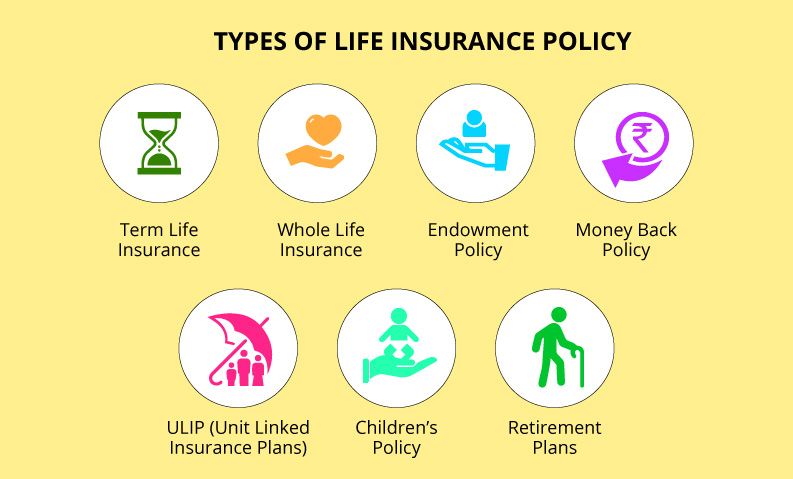

Types Of Life Insurance Policies In India Paisabazaar Com

Types Of Life Insurance Policies In India Paisabazaar Com

The Cost To Add Children To Your Term Life Insurance Quotacy

The Cost To Add Children To Your Term Life Insurance Quotacy

Gerberlife Ca Term Life Insurance Whole Life Insurance

Gerberlife Ca Term Life Insurance Whole Life Insurance

Converting Term Life To Whole Life Insurance Policy Bankers Life

Converting Term Life To Whole Life Insurance Policy Bankers Life

Individual Life Insurance Vs Group Term Life Insurance

Individual Life Insurance Vs Group Term Life Insurance

Term Life Insurance Unite Life

Term Life Insurance Unite Life

Kids Playing Health Insurance Insurance Policy Medicine Bright

Kids Playing Health Insurance Insurance Policy Medicine Bright

Best Life Insurance For Children Life Insurance For Children

Best Life Insurance For Children Life Insurance For Children

Term Life Insurance Definition 101 Guide On The Basics

Term Life Insurance Definition 101 Guide On The Basics

What Is Term Life Insurance Northwestern Mutual

What Is Term Life Insurance Northwestern Mutual

Voluntary Group Term Life Insurance Professional

Voluntary Group Term Life Insurance Professional

Term Life Insurance Whole Life Insurance Insurance Policy Png

Term Life Insurance Whole Life Insurance Insurance Policy Png

Why Caregivers Should Have Term Life Insurance Amica Life

Why Caregivers Should Have Term Life Insurance Amica Life

What Is Term Life Insurance And How Does It Work Haven Life

What Is Term Life Insurance And How Does It Work Haven Life

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

15 Whole Life Insurance Quotes For Children Best Life Quotes In

15 Whole Life Insurance Quotes For Children Best Life Quotes In