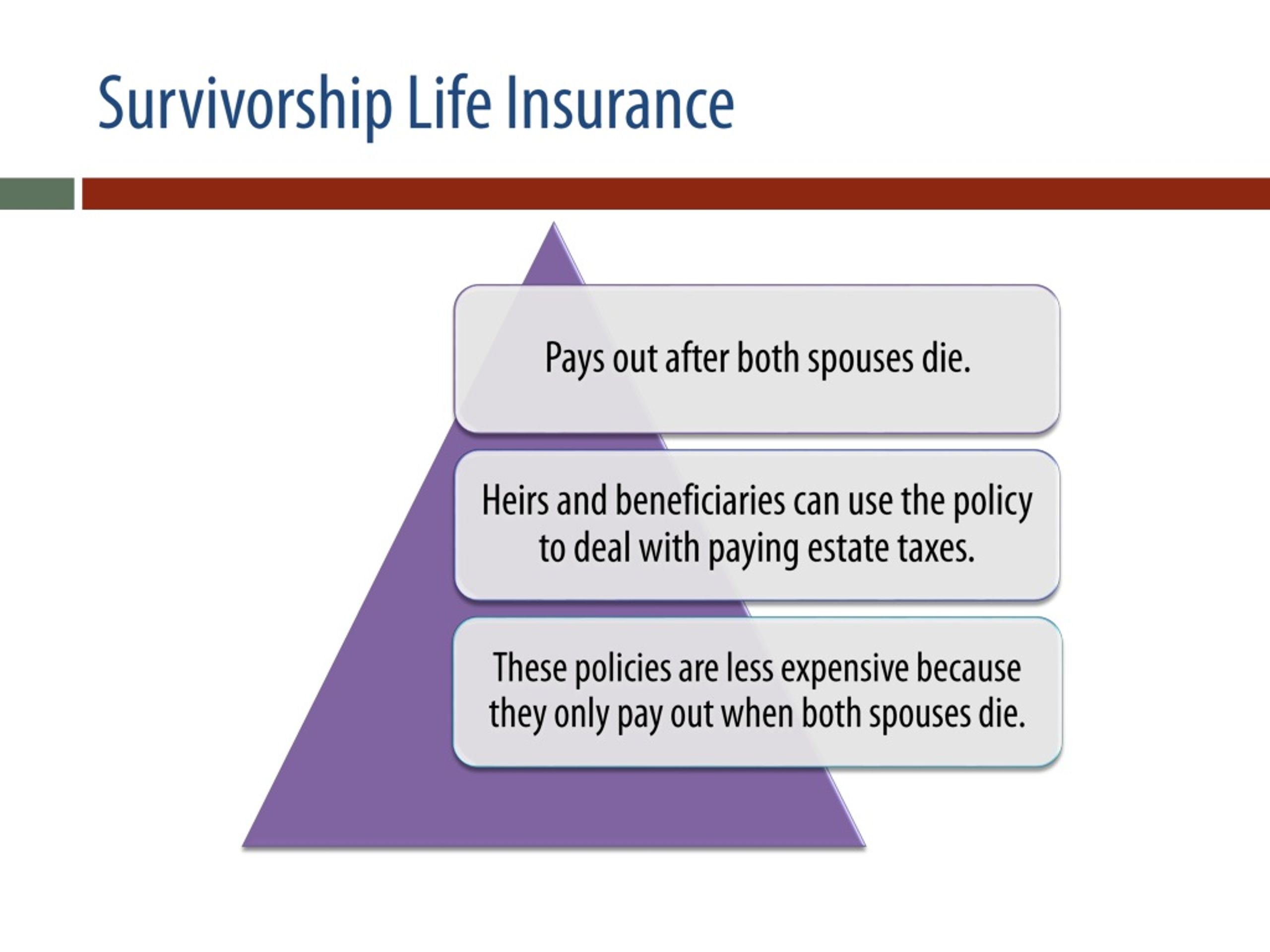

They are cheaper than many individual life insurance policies because although the insurance is. The survivorship life insurance policy is just one of the many life insurance products available that can really help families ensure that their loved ones are provided for in the coming years.

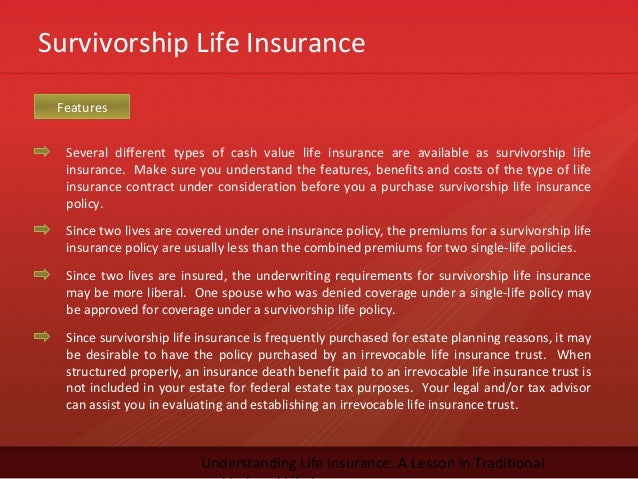

A survivorship life insurance policy is designed to insure two lives under one policy with one premium payment.

Survivorship life insurance policy. Survivorship life insurance benefits. Lets dive in and take a look. Survivorship life insurance also known as a second to die policy is an essential tool for estate planning inheritance planning and seeing to it that special needs dependents are financially taken care of when the insureds die.

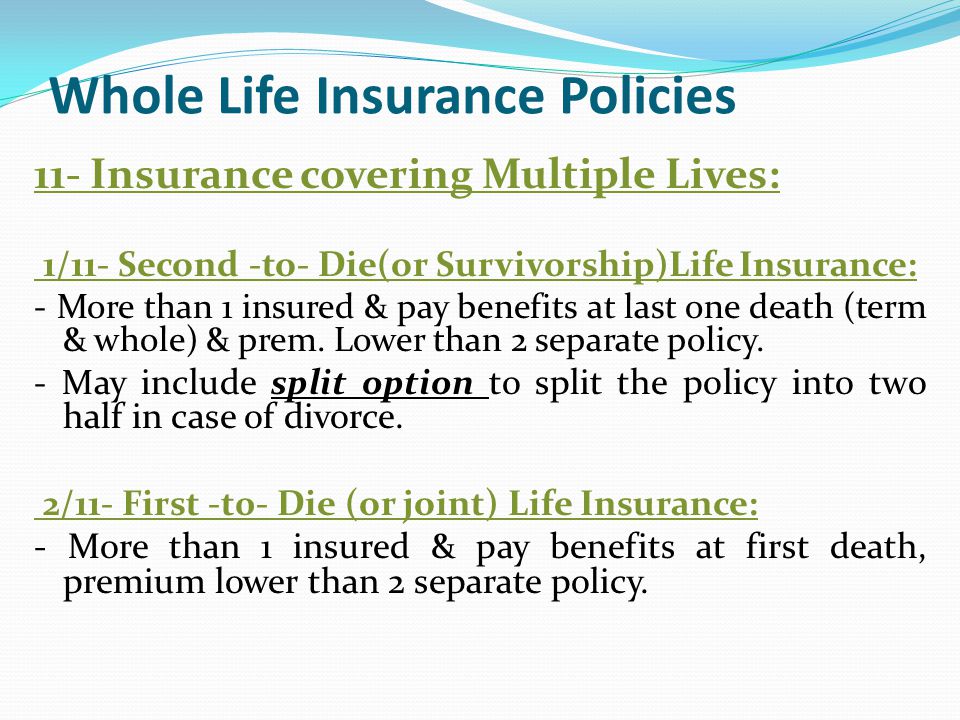

What is survivorship life insurance. Its referred to as second to die because the policy does not pay out until both. Another advantage of the survivorship life insurance policy besides leaving money to heirs after both spouses die is that when one spouse has died if there is cash value built up in the survivorship life policy then the surviving spouse may be able to cash in on the cash value of the policy as needed.

However both insureds must die before a death benefit is paid in other words only after the death of the second insured. What is survivorship life insurance. Ever wondered what is survivorship life insurancesurvivorship life insurance also known as second to die life insurance is a life insurance policy which only pays out when both halves of a couple often married couples or life partners have passed away.

Survivorship life insurance also known as joint survivor life insurance or second to die life insurance insures two lives and pays the death benefit upon the death of the second insured person. For this reason survivorship life insurance is often referred to as second to die life insurance. It is specially suited to meet the needs of high net worth families that are looking to avoid or mitigate the estate tax.

A survivorship life insurance policy or second to die life as it used to be called insures two lives usually a husband and wife. This type of policy is typically used for estate planning purposes but is also often used for parents of children with special needs. Survivorship life insurance differs in that it is a policy that is written on two lives.

Number one we are the 1 online survivorship life insurance brokerage. Survivorship life insurance an estate planning solution and estate planning tool. With over 40 years experience as a life insurance broker representing only the highest rated companies we are the largest internet based brokerage specializing in second to die or survivorship life insurance policies.

Estate tax the survivorship life insurance policy is. Survivorship life insurance also known as second to die life insurance covers multiple people and is often purchased by spouses. It makes sense in some situations.

A survivorship life insurance policy also known as second to die life insurance is a joint permanent life insurance policy that covers two persons. Unlike the first to die policy the second to die policy offers a pay out after both parties are deceased. Survivorship life insurance fits that description and might be a worthwhile purchase for people whose heirs will have to pay hefty estate taxes.

What Is A Second To Die Life Insurance Policy

What Is A Second To Die Life Insurance Policy

Irrevocable Life Insurance Trust Faq

Irrevocable Life Insurance Trust Faq

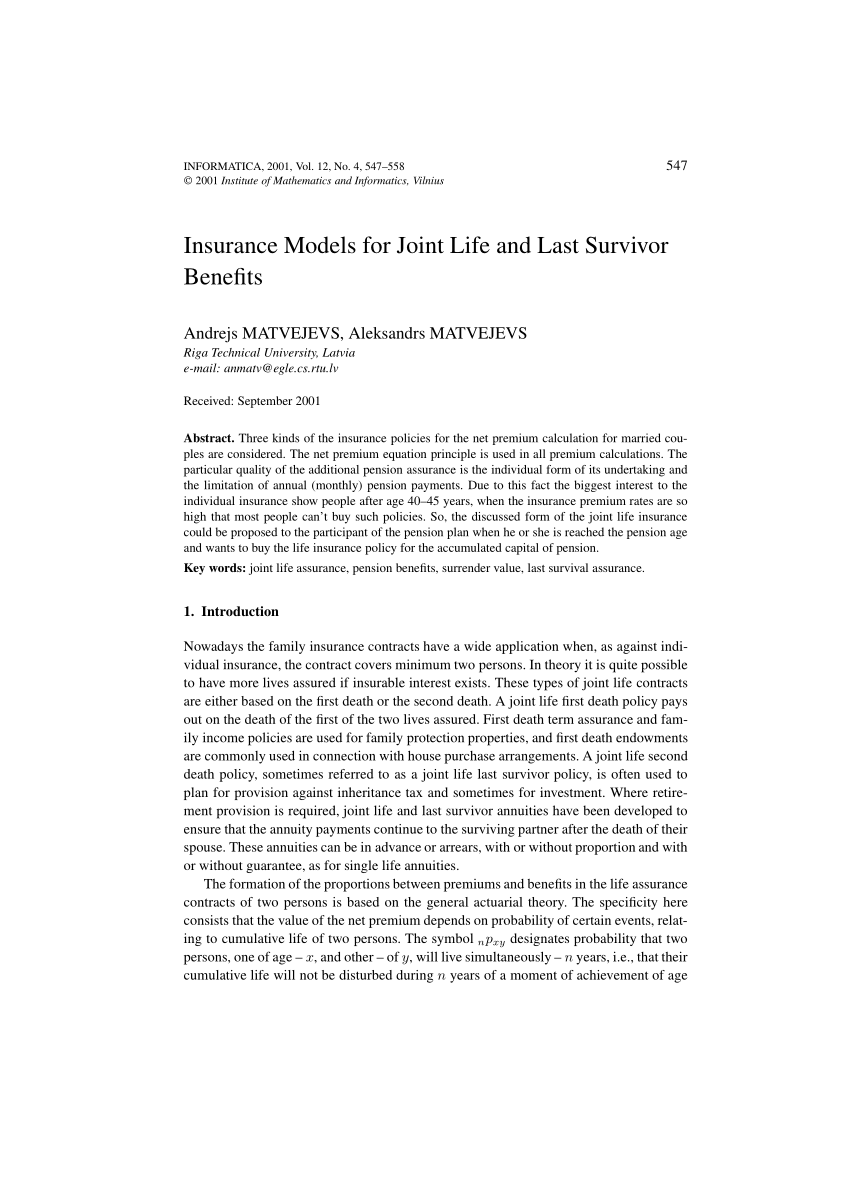

Pdf Insurance Models For Joint Life And Last Survivor Benefits

Pdf Insurance Models For Joint Life And Last Survivor Benefits

Policy Application And Coverage Selections

Policy Application And Coverage Selections

/how-to-decide-if-you-need-life-insurance-57afbb525f9b58b5c231cc04.jpg) When Should You Have Life Insurance What Are The Different Options

When Should You Have Life Insurance What Are The Different Options

Generalized Frasier Claim Rates Under Survivorship Life Insurance

Generalized Frasier Claim Rates Under Survivorship Life Insurance

The Construction Of A Survivorship Life Insurance Policy Pdf

The Construction Of A Survivorship Life Insurance Policy Pdf

Term Vs Whole Life Insurance What S The Best Option For You

Term Vs Whole Life Insurance What S The Best Option For You

Buying Life Insurance In A Qualified Plan

Buying Life Insurance In A Qualified Plan

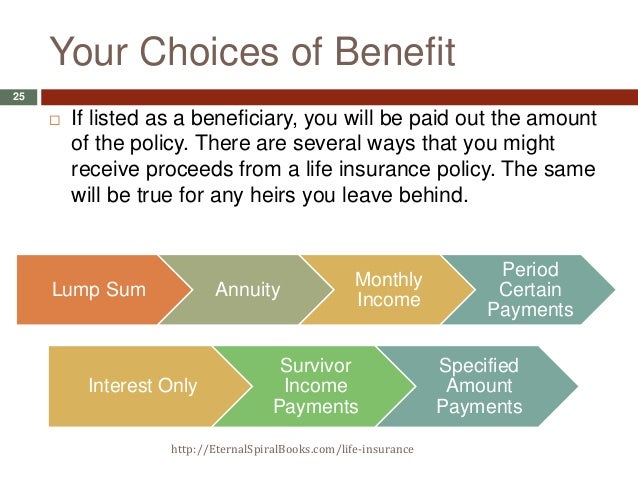

Life Insurance 101 Basics For Beginners

Life Insurance 101 Basics For Beginners

Debunking 21 Myths About Life Insurance True Blue Life Insurance

Debunking 21 Myths About Life Insurance True Blue Life Insurance

Life Insurance Quotes 250k Of Coverage From 8 Mth Smartasset Com

Life Insurance Quotes 250k Of Coverage From 8 Mth Smartasset Com

Life Insurance Policies Whole Life Insurance Ppt Download

Life Insurance Policies Whole Life Insurance Ppt Download

What Is Survivorship Life Insurance Term Life Insurance Usa

What Is Survivorship Life Insurance Term Life Insurance Usa

Ppt Life Insurance 101 Powerpoint Presentation Free Download

Ppt Life Insurance 101 Powerpoint Presentation Free Download

Life Insurance In The Estate Plan And Incapacity Planning Ppt

Life Insurance In The Estate Plan And Incapacity Planning Ppt

Newsletter An Affordable Insurance Solution An Affordable

Newsletter An Affordable Insurance Solution An Affordable

Actuarial Analysis Of Single Life Status And Multiple Life

Actuarial Analysis Of Single Life Status And Multiple Life

Types Of Life Insurance Policies Term Permanent

Types Of Life Insurance Policies Term Permanent