Rather than to debate the pros and cons of term vs whole life insurance we think the most important thing to consider first is why you are buying life insurance. Pays benefits only if you die while the term of the policy is in effect.

Whole Life Vs Term Life Insurance Here S What You Should Know

Whole Life Vs Term Life Insurance Here S What You Should Know

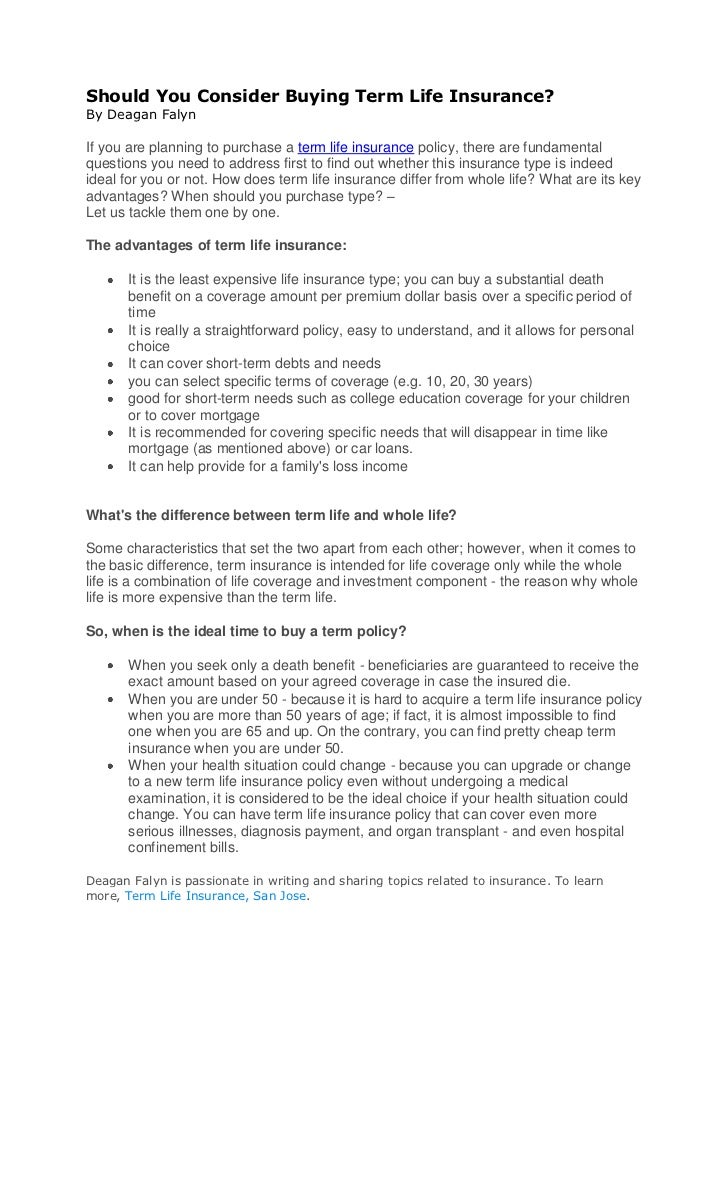

Purchased for a specific time period such as 5 10 15 or 30 years known as a term.

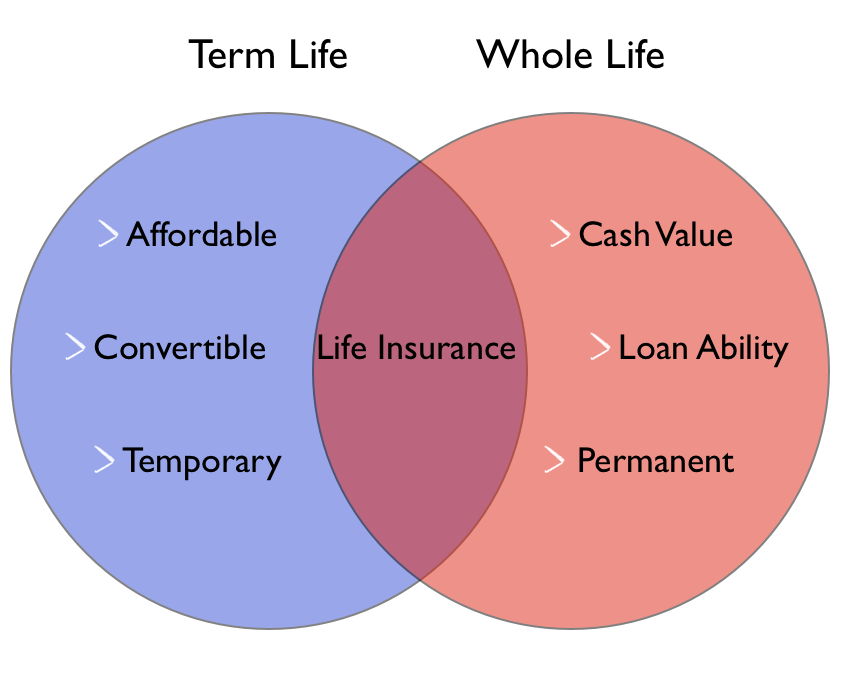

Should you buy term or whole life insurance. These options have several different features and they serve different purposes. This is an excellent article for people interested in making the right choice and illustrating the benefits of a whole life insurance policy. Heres a break up of both variants so you can make the best choice for your loved ones based on your needs.

Should you buy whole life insurance. Is also a ripoff. Here are some of the main features of term and whole life insurance.

Provides death benefits only. Heres a quick guide to the pros and cons of term and whole life insurance. Term life and whole life are the most popular variants of life insurance plans.

The purpose of life insurance. Which is best for you. Once you know you need life insurance it is important to buy the right type of life insurance.

For most people the need to buy life insurance is usually linked to key stages in life. Im going to first explain how. The primary purpose of life insurance in itself is replacing the income lost due to death of the insured.

The first important decision youll have to make when comparing types of life insurance is whether youd like to opt for a term or whole life policy. Do not fall for the idea that wlf or ulf forces you to save and builds value. Whole life insurance is a rip off and nothing more.

As youll see shortly they are completely wrong on this. Life insurance agents love to argue that when it comes to term life insurance or whole life insurance whole life is a better deal. To grasp the value of whole life insurance you need to see how it and term life insurance operate in practical terms.

Easiest and most affordable life insurance to buy. You have two basic options to choose from term life insurance or whole life insurance. The only type of life insurance you should ever buy is term life insurance.

Features of term life insurance. We got term and whole life quotes from accuquote an online broker that sells. One of the greatest arguments in the financial services industry has been the pros and cons of owning term or whole life insurance.

If you want to build your wealth invest in stocks bonds precious metals and real estate.

How To Save Money On Whole Life Insurance Using Term Blending

How To Save Money On Whole Life Insurance Using Term Blending

Term Life Insurance Vs Whole Life Insurance

Term Life Insurance Vs Whole Life Insurance

Why You Should Buy Term Life Insurance Instead Of Permanent Whole

Why You Should Buy Term Life Insurance Instead Of Permanent Whole

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Term Life Insurance Vs Whole Life Insurance Ray Alliance

Term Life Insurance Vs Whole Life Insurance Ray Alliance

Search Q Cash Value Life Insurance Tbm Isch

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Vs Whole Life A Consumer S Guide

Term Life Vs Whole Life A Consumer S Guide

Term Vs Whole Life Insurance What You Need To Know

Term Vs Whole Life Insurance What You Need To Know

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Common Misconceptions About Term Insurance Sg Budget Babe Dayre

Common Misconceptions About Term Insurance Sg Budget Babe Dayre

When Should You Buy Term Life Insurance

When Should You Buy Term Life Insurance

When Should You Choose Term Insurance Instead Of Whole Life

When Should You Choose Term Insurance Instead Of Whole Life

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Whole Life Insurance What You Need To Know

Whole Life Insurance What You Need To Know

How To Shop For Life Insurance Should You Buy Term Or Whole Life

How To Shop For Life Insurance Should You Buy Term Or Whole Life

Should I Buy Term Or Whole Life Insurance

Should I Buy Term Or Whole Life Insurance

Search Q Buy Term And Invest The Difference Tbm Isch

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

Term And Whole Life Insurance Which Is Better

Term And Whole Life Insurance Which Is Better

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Working Adult Guide Term Life Or Whole Life Insurance Which

Working Adult Guide Term Life Or Whole Life Insurance Which

Make Life Insurance Choice Easier With Financial Planning Unbroke

Make Life Insurance Choice Easier With Financial Planning Unbroke