2008 42 issued july 1 2008 the service ruled that insurance premiums paid by an s corporation on an employer owned life insurance contract on an employee of which the corporation is the beneficiary do not reduce the corporations accumulated adjustments account aaa. Nondeductible life insurance premiums some s corporations take out life insurance premiums on behalf of their employees and the s corporation itself is the beneficiarythese are referred to as corporate owned life insurance or coli for shortalthough these insurance policies can greatly benefit a s corporation if it loses a key officer or director the cost of monthly premiums is not deductible.

Sears Retirees Life Insurance Payouts Could Be Just Us 135 Each

Sears Retirees Life Insurance Payouts Could Be Just Us 135 Each

I have just know found out that i have to add health insurance premiums paid for my 2 s corp owners and each others life insurance premiums to their wages so that they appear on their w 2s.

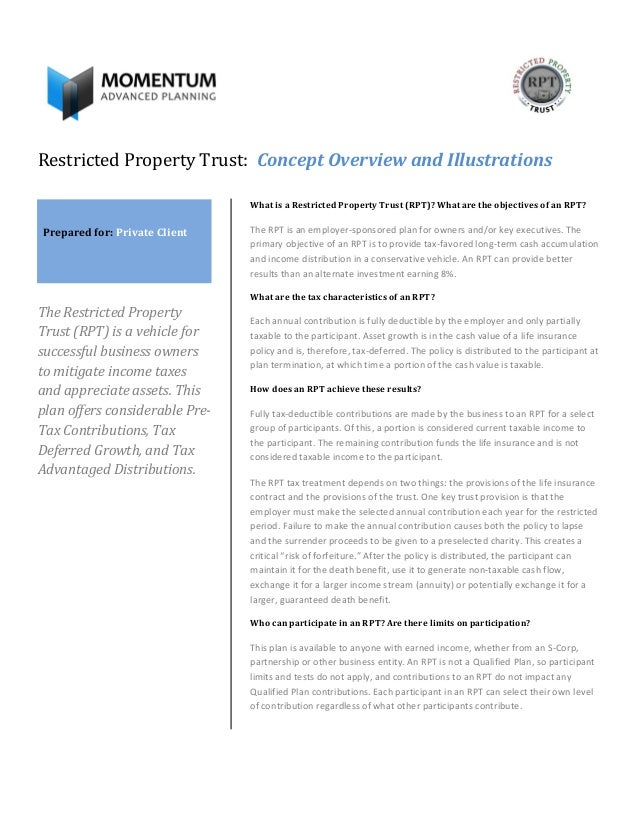

S corp life insurance. The fringe benefits that must be included in w 2s are health insurance including long term care hsa contributions disability insurance group term life insurance cafeteria plans and. In some instances the life insurance policy may provide enormous benefits. An employer owned life insurance policy on an owners life may or may not be critical to the future of your s corporation.

I am panicking because i dont know how to do this and i dont want to delay processing everyones w 2s while i try to find this out. In most cases the premiums are not deductible but they can still be financed by corporate dollars which is better than using after tax personal dollars. In particular it can provide the company the liquidity to redeem an owners shares in the event of death.

Two things to think about here. A corporation can be a beneficiary of a life insurance policy. Life insurance can be an important tool for an s corporation.

S corporation fringe benefits to shareholders. If you are a 2 shareholder and offer the same medical insurance plan to all your employees the tax tracking type typically used for this payroll item is s corp pd med premium. But other times its a huge waste of money costing you thousands in unnecessary premium payments.

Again this year certain fringe benefits must be included in your w 2 if you are a shareholder. Similarly if the shareholder purchased the health insurance in his own name but the s corporation either directly paid for the health insurance or reimbursed the shareholder for the health insurance and also included the premium payment in the shareholders w 2 the shareholder would be allowed an above the line deduction. The s corp will be the owner and beneficiary of a 2000000 insurance policy on as life and a 2000000 insurance policy on b.

However life insurance policies are subject to unique tax rules that are not always well understood. Can someone please give me a crash course on the simplest way to do. The clients attorney cpa and financial professionals agree that a life insurance funded s corp stock redemption with short tax year election language would accomplish the objectives of this plan design.

This generally allows the corporation to pay the premiums for that policy and collect proceeds upon the death of the covered person. I can help you make sure that the s corp medical and life insurance payroll item affects the federal and state taxes in the w 2 form.

Best Life Insurance In The Philippines Moneymax Ph

Best Life Insurance In The Philippines Moneymax Ph

Should You Choose S Corp Tax Status For Your Llc Smartasset

Should You Choose S Corp Tax Status For Your Llc Smartasset

The Three Levels Of Business Succession Planning Ppt Download

The Three Levels Of Business Succession Planning Ppt Download

Manila Bankers Life Insurance Corp

Manila Bankers Life Insurance Corp

Best Business Communtiy The World S Business Marketplace Job

Best Business Communtiy The World S Business Marketplace Job

Self Directed 401k And Self Directed Ira K A Lindow Phoenix Az

Self Directed 401k And Self Directed Ira K A Lindow Phoenix Az

Top 10 List Why Life For The Livinga Should Be

Top 10 List Why Life For The Livinga Should Be

The Insurance Based Income Solution Ppt Download

The Insurance Based Income Solution Ppt Download

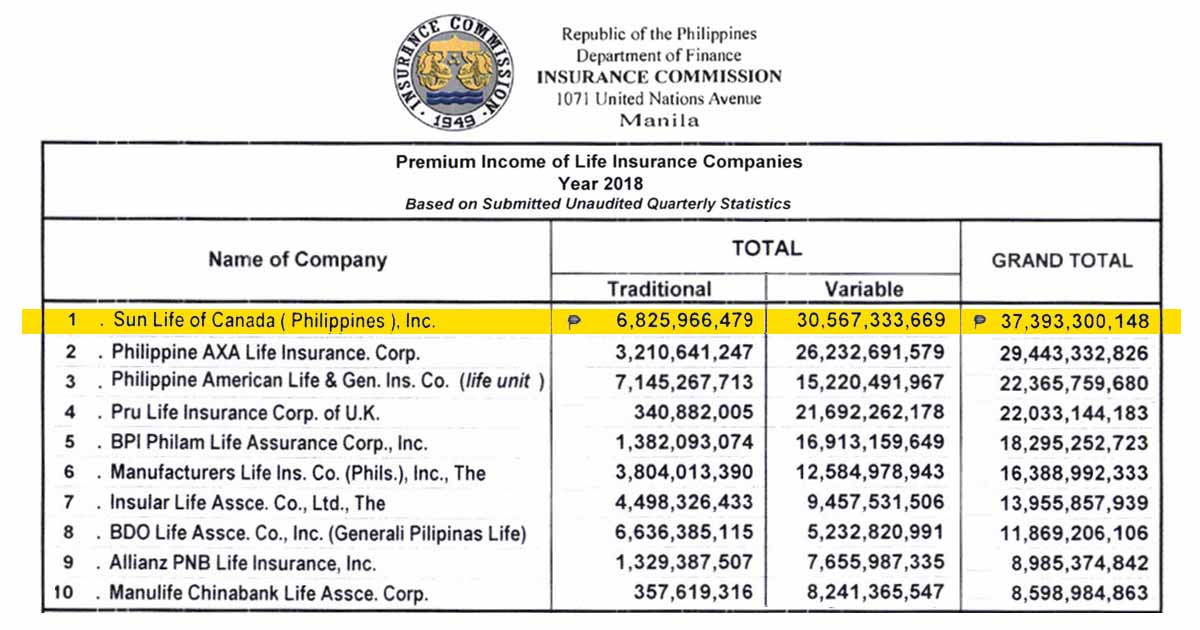

The Top 10 Life Insurance Companies In The Philippines 2019

The Top 10 Life Insurance Companies In The Philippines 2019

Life Insurance Products Pru Life Uk

Life Insurance Products Pru Life Uk

Insurance Fraud How Insurance Firms Are Dealing With Fraud Claims

Insurance Fraud How Insurance Firms Are Dealing With Fraud Claims

The Top 10 Life Insurance Companies In The Philippines 2019

The Top 10 Life Insurance Companies In The Philippines 2019

Fringe Benefits For More Than 2 Shareholders Of An S Corporation

Fringe Benefits For More Than 2 Shareholders Of An S Corporation

The Life Insurance Handbook Louis S Shuntich 9781592800575

The Life Insurance Handbook Louis S Shuntich 9781592800575

Best Life Insurance In The Philippines Moneymax Ph

Best Life Insurance In The Philippines Moneymax Ph

Https Www Gtcapital Com Ph Axa Philippines 1

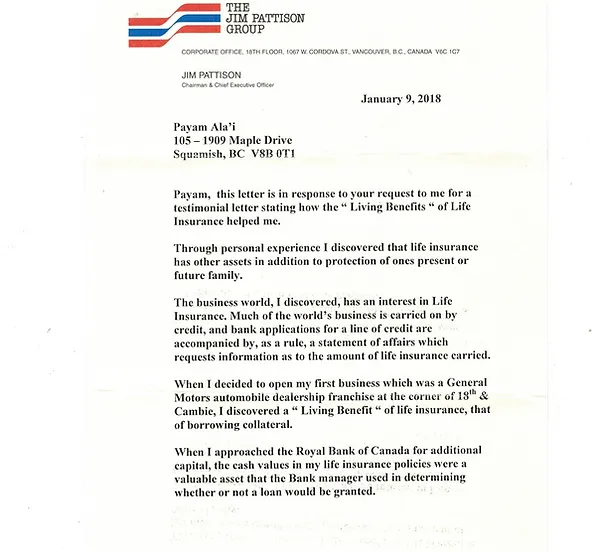

Corp Jim Pattison S Testimonial Alairiskmngmt

Corp Jim Pattison S Testimonial Alairiskmngmt

![]() Protective Life Insurance 2019 Company Review

Protective Life Insurance 2019 Company Review

Life Insurers Growing Bbb Portfolios May Cause Trouble In

Life Insurers Growing Bbb Portfolios May Cause Trouble In

Home Western Guaranty Corporation

Home Western Guaranty Corporation

Mblife A Scam Truth Manila Bankers Life Insurance Corporation

Mblife A Scam Truth Manila Bankers Life Insurance Corporation

What Does Insurance Cover For The Owners Corporation Edocr

What Does Insurance Cover For The Owners Corporation Edocr